Most people require assistance when it comes to preparing and filing a tax return. Some may even find themselves having to provide additional information to the IRS and do not know what it is or where to find it.

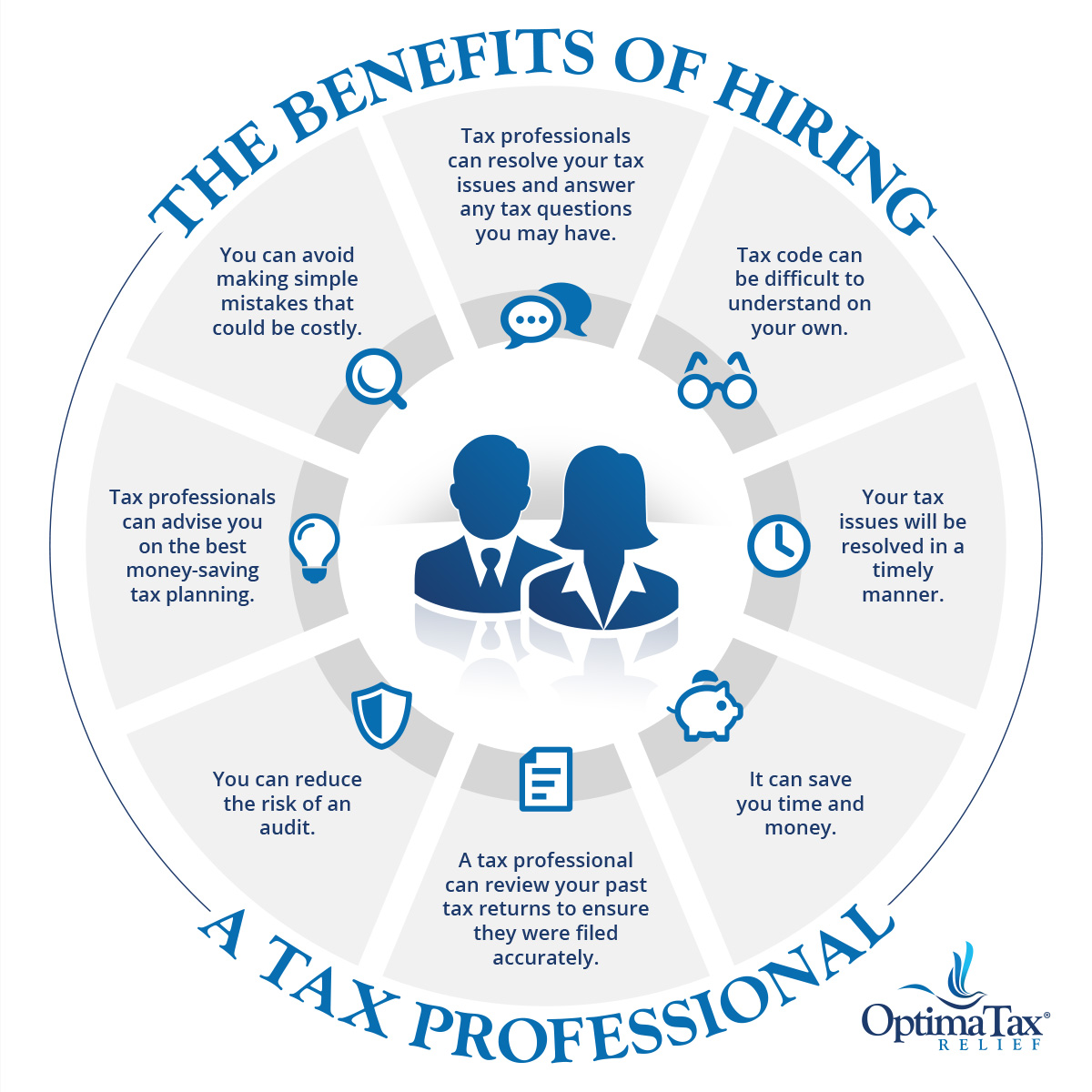

Hiring a tax professional could save individuals both time and money when dealing with the IRS. Tax professionals can also prepare tax returns, help file income taxes, and assist taxpayers when it comes to dealing with the IRS, tax notices, tax liabilities, audits, and more.

Types of Tax Professionals

There are various types of tax professionals who specialize in focused areas of tax relief or tax prep and carry specific professional licenses.

- Certified public accountants or CPAs can provide a variety of services such as:

- Maintaining financial records.

- Examining financial statements.

- Providing auditing services.

- Preparing tax returns.

- Some CPAs specialize in tax planning and preparation such as:

- Tax audits.

- Payment and collection issues.

- Appeals.

- Enrolled agents are trained to find federal tax matters and are licensed by the IRS. Enrolled agents can assist with the following:

- The preparation of both individual and business tax returns.

- The representation of clients.

- Other aspects of being a tax professional.

- A tax attorney is licensed by the state to practice law. Most states require an attorney to have a law degree and pass a test administered by the state (bar exam). Tax attorneys can assist taxpayer with:

- The preparation of tax returns.

- Tax planning.

- Providing advice to clients on long-range strategies for reducing their taxes.

- Like CPAs and EAs, tax attorneys have unlimited rights to represent a client before the IRS.

Areas of expertise

There are a range of services that tax professionals can provide to taxpayers that can help them understand their taxes better. Based on what service you need, choosing the right tax professional or tax preparer can help you get back on track with your taxes, small business, and much more.

- Enrolled Agents are IRS-authorized tax professionals who work alongside the U.S. Department of the Treasury by providing representation to individuals who need tax assistance.

- Certified Public Accountants (CPAs) have state certifications to practice accounting. These experts can help individuals navigate certain tax situations. CPAs are licensed to represent taxpayers before the IRS.

- Retirement tax professionals can help individuals know how their retirement options will impact their taxes. These types of tax professionals have received advanced training in tax preparations specifically for retirement plan contributions, distributions, and rollovers.

- Small Business/Sole Proprietor tax professionals specialize in working with small businesses’ tax returns and educate their clients on how to properly prepare both their personal and company returns. These types of tax professionals have specialized training in sole proprietors, partnerships, and S corporations.

- Investment Income tax professionals specialize in big or small investments, and gains or losses. These tax professionals also show your current and future tax situations.

- International Taxation tax professionals assist individuals who have lived or worked abroad. These tax professionals are trained in international taxation which includes, claiming foreign earned income exclusions, the foreign tax credit, or treaty benefits for nonresident aliens.

Professional Licenses

Enrolled Agents (EAs) and Certified Public Accountants (CPAs) are both experienced professionals who maintain high ethical standards. The main difference between an EA and CPA is that an EA specializes specifically in taxation. CPAs can provide a wider scope of tax services for individuals.

Working with an EA would be beneficial for those who have IRS issues such as individuals who are in collections or dealing with an audit with the IRS. An EA would be best suited for someone who needs assistance with the IRS to help them with their tax concerns. EAs are also a great option for those who need tax preparation assistance and planning advice for both individuals and businesses.

CPAs specialize in tax preparation that can help individuals identify both their credits and deductions that can help them qualify for an increase in their refund or help lower their tax bill. CPAs are also beneficial if someone needs their tax information compiled, reviewed, or audited.

When should I hire a Tax Professional?

You should hire a tax professional if you are short on time, are unsure how to file your taxes correctly, or feel overwhelmed by IRS forms with preparing your taxes. Tax professionals can help answer tax questions that you may have and even resolve most tax issues you may have.

The tax code can be very complicated and if you are unsure on how to handle your tax matters, a tax professional can assist. For example, a tax professional can help reduce the risk of any audit and know how to deal with the IRS on your behalf if you do end up being audited. Tax professionals can also help taxpayers avoid making costly mistakes on their tax return such as missed deductions or triggering an IRS letter. Tax professionals can also review previous tax returns to see if there were any errors and needs to be amended.

How to find the right Tax Professional for you

Individuals searching for tax assistance should follow these steps in order to find a tax professional who best fits their needs:

- Confirm your preparer has a tax identification number (ITIN).

- Make sure to confirm tax fees to ensure you are not being overcharged.

- Avoid tax preparers who do not e-file tax returns.

- Make sure that your tax preparer signs their name and provides their Preparer Tax Identification Number (PTIN) on your tax return.

- Make sure your tax professional can respond to the IRS. Enrolled agents, CPAs and attorneys that have a PTIN can represent you when it comes to IRS audits, payments, and collection issues.

10 Questions to ask a Tax Professional

- Do you have an IRS-issued Preparer Tax Identification Number (PTIN)?

- How do you keep up with the latest tax law? Are you regularly taking education courses?

- Do you offer a free initial consultation?

- Will you be the one preparing my return or someone in your office?

- Do you offer IRS e-file, and will my tax return be submitted to the IRS electronically?

- Will you keep my records and receipts on file? How long will you keep my records for?

- When do you require payment?

- When can I expect to receive my completed tax return?

- What happens if I get audited?

- Do you outsource your tax preparation?

Things to look out for when hiring a Tax Professional

Taxpayers should be aware of any red flags they experience when looking to hire a tax relief professional. Here is what individuals should look out for before hiring a tax professional:

- Check the preparer’s qualifications.

- Review the preparer’s history.

- Ask about services and fees.

- Make sure that the preparer offers e-filing.

- Ensure your preparer has open availability if you have additional questions regarding your taxes.

- Never sign a return if your preparer has added their name or PTIN.

How much does it cost to hire a Tax Professional?

The average cost of hiring a tax professional will depend on the complexity of the case that they are working on.

Consequences of not Hiring a Tax Professional

The federal tax penalties you could face by not hiring a tax professional to help you prepare your taxes could far outweigh the cost of soliciting tax help. Here are the repercussions individuals could face if they choose to not hire a tax professional:

- Filing your own taxes could be time-consuming and confusing if you have never filed before.

- You can miss out on tax preparation fees that could have been deductible.

- You could miss out on certain credits or deductions if you are not aware of them.

- If you get audited, you will not have a tax professional that can assist you through the process.

- Filing your own taxes could lead to you making avoidable mistakes that could cause you problems with the IRS down the road.

Tax Relief Services at Optima Tax Relief

Optima Tax Relief offers tax relief services to individuals who are struggling with their IRS or state tax debt. Taxpayers that need assistance with tax preparation, setting up a payment plan with the IRS, getting out of collections, resolving an audit, or are looking to see if they qualify for a possible reduction in their total tax debt, should consider using Optima’s services.